Absolute Return Overview, How To Calculate, Features

Contents

I’m fresh to Mutual funds and invested with very basic financial knowledge. Now I have learnt some basics and looking forward to learn more….. CAGR is good for lumpsum investments, but where there are different cash inflows and cash outflows, like in SIPs, CAGR is not the right measure. Mr. Vedant, a marketing executive, invested Rs. 1 lakh in Axis Bluechip Fund in 2015 for a period of 5 years. He invested on 22nd July 2015, at a NAV of 20.04, and got 5,000 units allotted to him.

A FREE assessment that tells you what kind of investor you are, your risk tolerance levels, and a lot more. Also, for a better understanding of all return types, we will take an example of Axis Bluechip Fund. World-class wealth management using science, data and technology, leveraged by our experience, and human touch. Absolute return is the return that an asset achieves over a certain period.

- An investor may have the annual rate of returns for each year for the investment period.

- Very helpful Blog the critical money matters related to investment in MF is described In a simple way.

- Investors can compare the CAGR in order to know how well one stock/mutual fund has performed against other stocks in a peer group or against- market index.

- A casual investor is generally content with the feeling that the value of his investment is more than the capital invested.

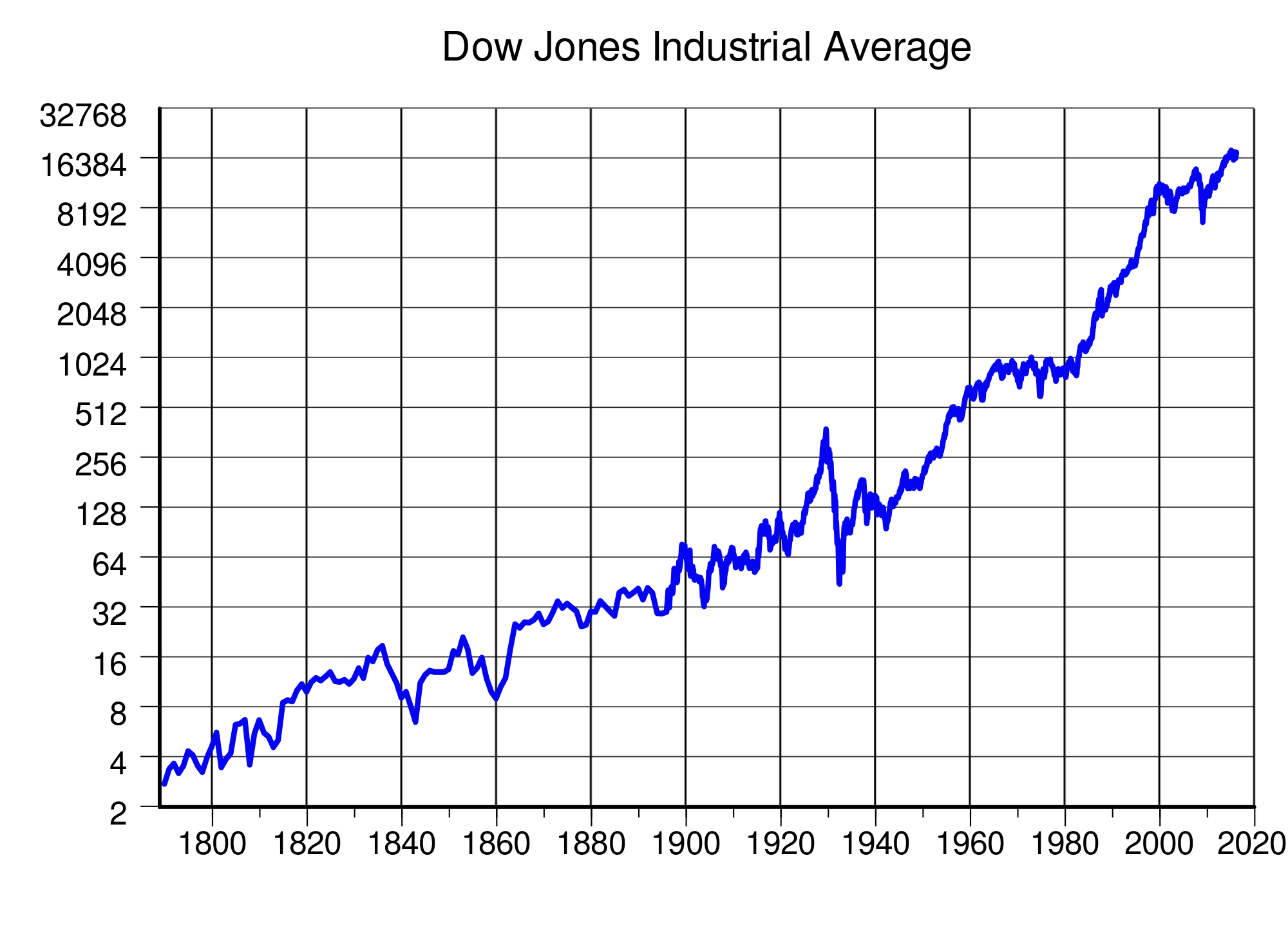

Absolute return investment strategies include using short selling, futures, options, derivatives, arbitrage, leverage, and unconventional assets. Absolute returns are examined separately from any other performance measure, so only gains or losses on the investment are considered. Investors always want to measure the returns various investments have achieved in the past, but often have different ways of doing so. One frequent difference is with regard to the time period used.

Top Fund Houses

Calculating absolute returns is easier as compared to calculating annualized return on investment. It is a measure of how much the initial investment has become without taking into consideration the period in its computation. Further, this measure is a straightforward process with no relative action against any benchmark, which makes this measure of return receive a lot of criticism. Also, since returns are measured in absolute terms, it can provide misleading results on a lower base compared to a higher asset size base. In this annualized total return formula, ‘R’ refers to the cumulative return.

Awareness and knowledge about calculating the returns from investment is important to be a smart investor. CAGR is a way to smoothen out the returns, it determines an annual growth rate on an investment whose value has fluctuated from one period to the next. This is similar to saying that you went on a trip and averaged 60km/hr. Sometimes you were traveling slower, other times faster. It helps you to calculate the simple returns on your initial investment.

On the other hand, one can compare the annualised return of two investments and can choose the one with a higher annualised return. Absolute return is the return from an investment over a specific period of time. Expressed as a percentage, it measures the total appreciation or depreciation in the value of the asset. It can be positive or negative and measures the total gain or loss from the investment. Absolute returns, also known as point-to-point returns, calculate the simple returns on initial investment.

Annualized returns are expressed in percentage only, but an absolute return can be expressed in both INR and percentage. Here, the what is absolute return and annualised return investor made an absolute return of 23.53% on the property. In the above formula, ‘R’ refers to the annual return for a year.

In simple words, trailing returns is calculation of point-to-point returns and then annualising them. The absolute return funds are actively adjustable to the movements of the equity market. This means that when the market is on a decline, it shares a negative correlation with the absolute return funds and vice-versa. As mentioned above, the primary aim of the portfolio is to generate positive returns at all costs/ Therefore, in this case, the diversified portfolio is made. Making a diversified portfolio is to spread the risk with different investment options that can generate returns in different ways for different periods.

CAGR is compounding of returns earned over a period of time. It provides a snapshot of an investment‘s performance but doesn’t give investors any indication about the volatility. Absolute return refers to the amount of funds that an investment has earned. Also referred to as the total return, the absolute https://1investing.in/ return measures the gain or loss experienced by an asset or portfolio independent of any benchmark or other standard. Returns can be positive or negative and may be considered uncorrelated to other market activities. As the name suggests, annualised return determines the investor’s returns annually.

The History of Absolute Return Funds

It is that investment returns, when assessed relative to a said benchmark or market index, reflect on the gain or loss made by the investor. However, absolute returns are considered an important indicator of how much an investor made or lost in absolute terms. An absolute returns strategy aims at generating positive returns at all costs, regardless of whether the equity markets are rising or falling. It is the primary aim of the investment strategy that the investment portfolio is structured around.

But again in 2019, it fell down to a mere return of just 2.06%. So CAGR doesn’t give the investor a vivid account of all these ups and lows in the returns of the fund on an annual basis. Annualized return is the geometric average return the investment has earned every year during the investment duration. Annualized return determines the average rate at which the fund’s value has increased yearly to achieve its current value. Whereas absolute return shows how much the investment has grown from its starting value. This return works based on the current value of investment and initial investment amount.

Investors would want to periodically check how much their investment has grown or how much a potential investment would give. With technological advancements, one can easily use online calculators to estimate their returns. However, having the knowledge on calculating mutual fund returns would come in handy.

Mirae Emerging Bluechip Fund belongs to the Large & Mid Cap category, and so, it has the mandate to invest at least 35% of its corpus in large-cap stocks and another 35% in mid-caps. Citizens MF investment, we’ll be doing a blog on that shortly. We feel glad that this article was able to resolve all your doubts regarding Mutual Fund Returns.

We can solve this problem by converting returns to a common holding period i.e., one year. The holding period of investments can be in terms of days, months, or years. First thing to do is to convert the holding period to the same unit i.e., day, month or year.

Calculating Returns And Lazy You

Due to market fluctuations, performance in a particular year might differ considerably from the previous year. As a result, the annualised return technique makes it easier to compare the performance of various mutual funds across different periods. The annual gain which you make on your investment is called an annualized return. It can be a simple annualized rate of return, an average simple annualized returns or compound annual growth rate.

IRR is useful when you are investing your money at regular intervals or on a periodic basis like SIPs. The amount invested may vary but the time of investment is at regular intervals. The main aim of an investment is to make a profit, but far too many people treat investments in a reckless manner without a thorough understanding of how they work. An investor could be engaged in a losing or inferior investment without even realising it if they don’t have this information.

Money9 Sites

This formula is used to calculate returns when the holding period is less than 12 months. Alex Dumortier, CFA, has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Netflix and Yahoo. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

Therefore, the investor can calculate the amount as follows. There is no single formula for the annualized total return that investors can use. Instead, they must use one of the several ways to calculate the annualized total return. This way will depend on the underlying information available to the investor. These include the returns for an investment for a period and the time they hold it. One of the most crucial reasons investors use the annual total return is its comparability feature.

Recent Comments